Categories

W5 on Segmentation

In today’s volatile and competitive economy, mass marketing is no longer the most efficient or cost-effective option to reach a target audience. With a limited marketing budget, why spend your resources marketing to an audience who is not likely to use your products and services? Market segmentation allows you to identify those who are likely to benefit from your products and services and those who are not viable prospects. This white paper illustrates the benefits of segmentation research for a variety of marketing needs.

What is Segmentation Research?

Segmentation research explores a target audience based on in-depth information beyond demographic characteristics and basic category behaviors. In typical market research studies, variation in responses can be identified through statistical analysis based on demographics such as gender, age, ethnicity, region, and income. However, when examining the market as a whole, this method of analysis does not give marketers and researchers the ability to understand and tailor their strategies to address the complexity of consumer personalities and their decision-making considerations.

Segmentation is a valuable research tool to develop and implement more effective strategies during all phases of the marketing process – from product development through advertising campaign messaging. A segmentation study uses individuals’ responses to questions concerning their core demographic makeup as well as attitudinal, behavioral, and psychographic questions to identify and target distinct consumer groups within the marketplace.

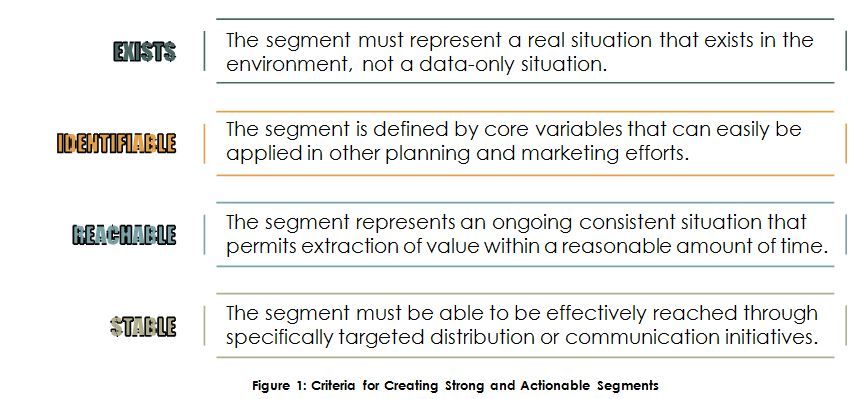

For a segmentation scheme to be actionable, or for it to be possible to identify and market to the resulting segments in the future, the members of each segment must think and behave similarly to one another and must also think and behave differently from the members of other segments. Additionally, the segments must be based on stable, real-world criteria, making some intuitive sense regarding the people they include.

Figure 1, below, outlines the core criteria for market segmentation:

Figure 2, below, is an example of a segmentation for the casual dining marketplace. These segments are based on a wide variety of data points that encompass consumers’ demographics, attitudes, behaviors, lifestyle and psychographics, category and brand perceptions and preferences.

As illustrated above, segmentations are generally more investigative in nature and provide actionable information with which to identify and differentiate distinct groups of target consumers. Segmentation research can provide information about how to target and market to groups based on what they think, how they feel, and how they act, in addition to basic demographic classifications.

How is Segmentation Research Conducted?

Questionnaire Development:

A W5 segmentation survey instrument includes a broad array of scalar batteries addressing consumer attitudes, behaviors, and psychographics. We do not employ a “standard” survey instrument, but develop a custom- crafted set of measures in addition to category- and brand-specific measures to address the strategic objectives driving the research initiative.

We believe in working closely with the client to identify needs, extract relevant information from existing research, and conduct exploratory qualitative research to expand upon our industry knowledge prior to designing the survey instrument. As a result, each client’s segmentation study truly reflects their unique, outstanding research needs and is positioned appropriately to reflect the culture of the organization. In developing a custom questionnaire for clients, W5 covers a variety of topics, including but not limited to:

Sample Size:

A sample size of N=600 to N=2,000 is recommended in market-oriented segmentation studies to allow for the construction and analysis of alternative groups. This large sample is required so that within-group similarities and between-group differences are statistically reliable and can therefore be examined in depth. Additionally, large sample sizes ensure that all appropriate and mean- ingful cohorts or demographic groups are included enabling a clearer picture of the true opportunities and challenges that exist.

Pre-Segmentation Data Analysis:

With each study, W5 develops a detailed tab plan to guide development of data tabulations, representing all questions in the quantitative survey and appropriate banners summarizing sub-groups of respondents.

Upon development of data analysis tools, W5 conducts a thorough quality control review of all data files, data tables, cross tabulations, and other research results used in the quantitative analysis. W5 applies best practices quality control procedures to ensure analysis and reporting is conducted to the highest standards and is in compliance with applicable regulations and client specifications. W5 desires to not only meet, but exceed, client expectations regarding the quality of the research analysis; to that end, W5 consultants work closely in teams to review all quantitative analysis tools.

How Are Segments Derived?

Segment composition is defined after study completion based on consumers’ demographics, attitudes, behav- iors, psychographics, and category and brand-specific perceptions and preferences. The profiling of the seg- ments focuses on understanding the following two key marketing issues:

1. What consumer segments exist and what is the relative size of each segment?

2. What are the behaviors, attitudes, and needs of each segment? How do they differ between segments?

Once defined, the value of each of these segments can be derived by looking at measures such as purchase likelihood and frequency. Figure 3, below, outlines the approach W5 takes to developing a custom segmentation model:

W5 has the experience, knowledge, and analytical tools to accurately identify homogenous groups of consum- ers based on segmentation data. We recognize that the development of accurate, identifiable, and action- able consumer segments is both a science and an art. As such, we employ a multi-phased statistical approach to identify the most appropriate and actionable segment groups for each of our clients.

1. Factor Analysis:

W5 conducts a factor analysis as the first step of multivariate data analysis in developing the segmentation scheme to identify and describe the specific groups that exist within the marketplace. The use of factor analysis is based on the assumption that there are a few hidden, or underlying, factors that manifest themselves in the values of a full set of variables. As such, factor analysis is employed to reduce a full set of attitudinal, behavioral, psychographic data points into a smaller set of variables, known as underlying “factors.”

For example, regarding the casual dining marketplace, a desire to remain fit may be an underlying factor that manifests itself through such variables as frequency of exercise, calorie-counting behavior, avoidance of fast or pre-packaged foods, and general attitudes about the importance of daily activity and healthy eating. The factor analysis is conducted to identify these underlying factors.

2. Cluster Modeling:

In order to generate the segmentation scheme, W5 produces cluster modeling of the data. To develop cluster solutions, W5 first identifies statistically significant differences in the underlying factors as determined in the factor analysis. W5 then identifies the factors that are relatively strong and relatively weak in explaining or predicting consumer behavior. The respondents who share like factors are then grouped into “clusters” of consumer types who can be described and targeted with relative ease.

Clusters consist of individuals who share a number of attitudes, behaviors, and psychographic characteristics. The process of defining the clusters, which is done by means of multivariate statistical modeling, is a combination of both science and art. The number and specificity of the clusters depends on the number of respondents included, the questions asked, and which questions are ultimately included in the cluster definition. However, W5 recognizes that results are not merely data-driven; they must also make theoretical sense and be appropriate to the business objectives at hand.

Typically, three or more alternative cluster solutions are developed for initial consideration. These cluster solutions are then evaluated and considered based on each client’s specific needs and objectives to determine the most actionable, reliable, and logical segmentation scheme.

In the following simplified example, outlined in Figure 4, four theoretically sound clusters emerged:

3. Discriminant Analysis:

W5 then employs a discriminant analysis to test the reliability of the segmentation scheme. First, the sample is divided into two parts, with the discriminant analysis conducted on one half of the sample to define the classification function. The other half is identified using the resulting classification function. The newly identified segments are then compared to the segments identified in the original segmentation scheme. This process permits the testing of the reliability of the classification function through measurement of how accurately the function classifies the second half of the sample into the original segments.

Using a discriminate analysis and testing the reliability of the segmentation scheme and classification function ensures that the resultant consumer segments are expected to be stable over time.

4. Predictive Algorithm:

The classification function developed through the discriminate analysis can be provided to the client to support future research. This algorithm is based on a condensed list of attitudes, behaviors, and psychographics that defined clusters in the segmentation so clients can quickly classify segment members in future research studies with a certain degree of reliability. Typically, predictive algorithms offer reliability between 0.65 and 0.70, meaning that they are able to accurately classify respondents into the correct segment between 65% and 70% of the time, compared to the overall segmentation conducted previously. A predictive algorithm is useful in follow-up studies to examine and understand consumer differences in opinions related to product development, pricing, and concept and message development, for example

In-Depth Reporting

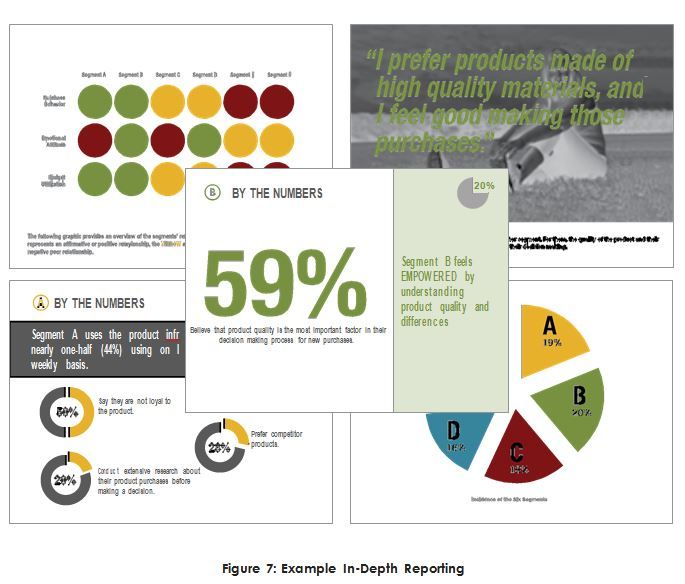

W5 serves not only as a research partner, but also as an analytical partner. As in all research engagements, W5 provides a full Final Report detailing the relevant findings of the research including a series of actionable conclusions, recommendations and specific key findings, demonstrated and illustrated through a series of graphs, charts, and tables. Figure 7 below represents an example of W5’s approach to in-depth reporting:

Within the Final Report, W5 provides in-depth profiles of each segment that provide an overall reference. In addition, W5 also develops “snapshot” takeaway slides featuring key segment information as shown in Figure 8. Beyond descriptive measures, W5 produces key implications for communications, strategy, product development, etc. depending on the specific study needs and objectives.

Frequently Asked Questions

What are the benefits of working with W5 for segmentation solutions?

W5 possesses a wealth of experience developing relevant and actionable segment solutions for our clients. W5 understands that a gap often exists between theoretical marketing research and marketing and sales. As such, W5 works closely with each client to identify key business objectives, developing consumer segments that not only make statistical sense but also bring target consumers to life, allowing for a full understanding of what the target audience is really about – from a behavioral, attitudinal, and psychographic perspective.

How are W5’s segmentation studies different from those developed by other research companies?

W5 does not subscribe to the idea that a client’s needs can be met with a “standard” segmentation survey instru- ment. Although we believe it is important to refer to previous research and our industry knowledge when devel- oping survey instruments, we do not rely on standard or previously designed and implemented approaches.

How can the results of a market-oriented segmentation study be applied to my business strategies?

W5 recognizes that market segments must be relevant and actionable, meaning the client is able to use behav- iorally, psychographically, and attitudinally-based segments to address their business strategies. While profiling resulting consumer segments, W5 focuses on such lines of questioning as desired products/services, specific category behaviors, the role of brand in consumer decision, purchase likelihood, information-seeking behavior, and media usage. These lines of questioning allow W5 to make clear recommendations regarding the best products to market to a particular segment, and the best channel through which to reach this target segment

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.